Group Health Plans

Changing to a Self-Insured Plan Design Can be Challenging. Regaining Control of Your Second Largest Cost, Priceless!

Better Plans, Better Pricing

We all understand the traditional healthcare system isn’t sustainable. Unfortunately breaking old habits can be uncomfortable. But, as they say, “If you keep doing what you’re doing, you’ll keep getting what you’re getting”. Archer Jordan understands the challenges employer groups face to change their buying decisions. Potential member service disruptions, the fear of the unknown, or worse.

As we walk through change together, we’ll make sure discomfort turns to relief as soon as possible.

We believe there is a better way.

Learn More about Our TPA services

Click Here

Reference Based Pricing 2.0 =

Value Based Pricing “VBP”

What separates Archer Jordan Health’s Value-Based Pricing “VBP”, cost containment strategies from other TPA’s Reference-Based Pricing “RBP”? We reduce cost and simultaneously increase quality and service which exponentially compounds value.

These questions represent low-hanging fruit, to establish a lower cost basis, high quality delivery, a faster more efficient service model, with greater healthcare value

Is there a advocate program in place to engage early and often in the member’s care continuum.

Are the Plan documents written in such a way that formulary and specialty drugs are negotiated and purchased at the lowest possible discounts?

How am I paying providers, am I paying for providers I am not utilizing?

Does the Plan document support using value based pricing as often as possible?

Along with national networks are local networks in place, and is there a provision to add providers to networks to create greater access?

Are local healthcare providers participating in regional networks?

Do you know how each player is being compensated, who pays who, and what the total in addition to administrative fees, networks and insurance amounts to?

Are members, providers and payers aligned and working from the same playbook?

Small Group Plans

Health plans designed with small businesses in mind.

Archer Jordan is on a mission to make healthcare affordable, predictable, and simple for small businesses. We give employers access to coverage comparable to the largest national plans – and they only pay for the healthcare services that their employees need.

Savings

Certainty

Employers pay a flat monthly rate and are protected from higher-than-expected costs.

Simplicity

We may be focused on large groups, but that doesn’t mean we can’t be focused on two things at the same time.

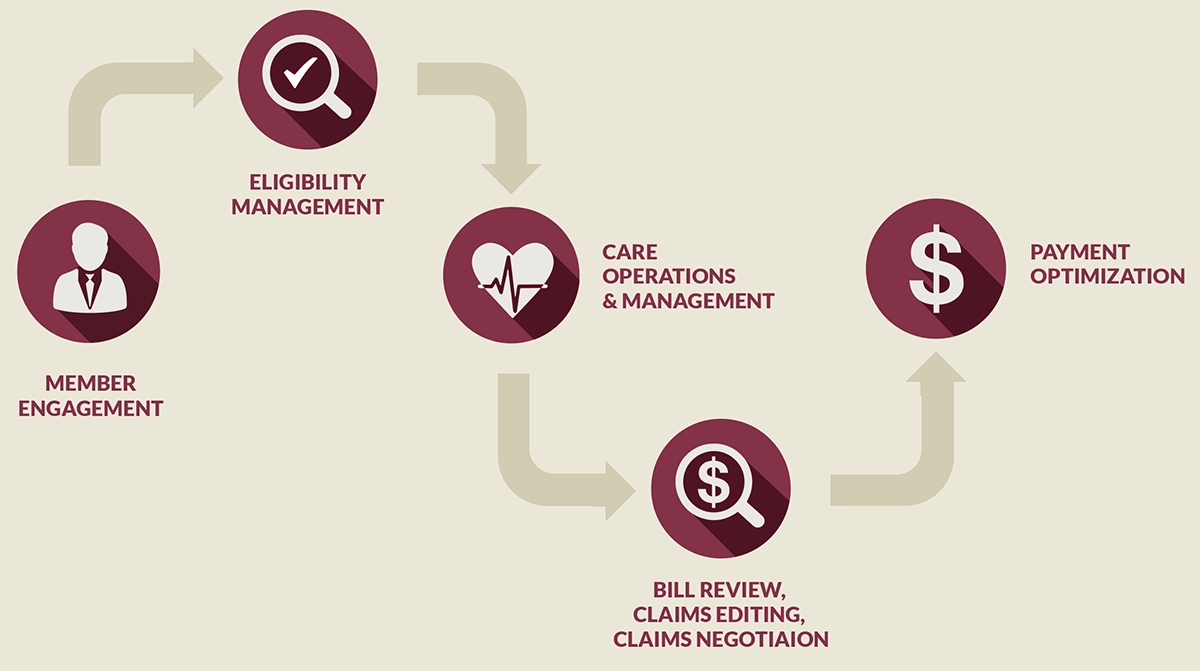

We Manage Your Health Plan From Design to Implementation

There are a Lot of Moving Parts to a Large Group Self-Funded Health Plan. Our Processes, Technology, and Over 40 Years of Experience Have Created a Well-Oiled Machine

The Cost of Group Health PPO Insurance Continues to Rise Each Year. It’s Time For a Change

People Solutions for Large Employer Groups

Government Contractors, Alaska Native Corporations, and Indian Country

Change is Hard, Not Fixing the Problem is Hard

(Choose Your Hard!)

Smart Companies Understand They Won’t Survive in Today’s Fast Changing World without Fixing Their Second Largest Expense, Healthcare. Let Us Show You How to Save Big, and Better Care for Your People

Plan

Design

– Actuarial Services

– Risk Adjustment and

Quality

– Market Based pricing

– Compliance

– Provider Network

Plan

Implementation

on-boarding and enrollment

– HR training, resource and

support

– provider decision support

Plan

Management

– TPA

– analytics

– transparent data

– better financial outcomes

– member support (protect

from overfilling, guidance)

“GM is a health and benefits company with an auto company attached. ”

Warren Buffett

How’s Your $20 Million Dollar Health Care Business?

Take Back Control!

See how our solutions like value-based pricing, and captive programs can help you take back control and protect your members from rising healthcare costs

Lower operational cost

Benefit Flexibility

Access to Data

Balance Risk and Financial

Performance

Remove payment friction

Improve Network

Performance

Boost Member Satisfaction

The Cost of Group Health PPO Insurance Continues to Rise Each Year. It’s Time For a Change

No Guesswork Involved

Archer Jordan’s Self-funded Group Health Plans are Driven by Facts, Administered with Care

Data

Driven

KNOWLEDGE

(data)

Cost

Driven

RISK

(Insurance)

Plan

Driven

SPD

(Summary Plan

Description)

Control

Driven

COST CONTAINMENT

STRATEGIES

(Control Driven)